How Creighton Federal Credit Union Crushed Email Marketing Benchmarks: A Case Study

In today’s digital age, email marketing remains a crucial tool for financial institutions to engage with their members. But how can credit unions stand out in crowded inboxes? Creighton Federal Credit Union (CFCU) found the answer, and the results are impressive.

Over the course of 90 days, their rotating Facebook ads generated 410k impressions, had an average reach of 128k and saw increased traffic on key landing pages on their site. These pages feature patient education documents and other helpful information. By focusing on brand awareness, overall interest in the ads was high, thus leading to more phone call clicks and interactions.

Key Takeaways:

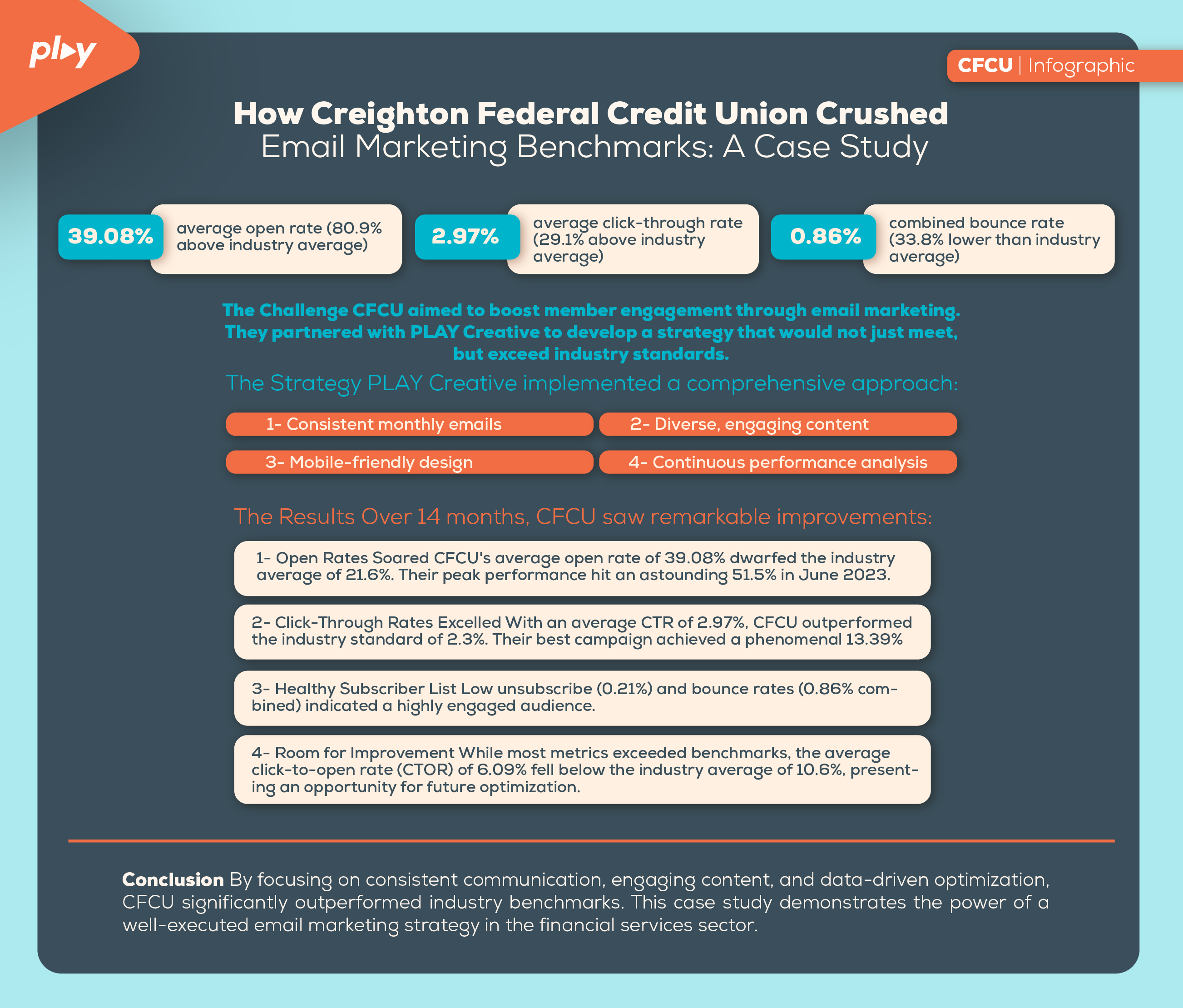

– 39.08% average open rate (80.9% above industry average)

– 2.97% average click-through rate (29.1% above industry average)

– 0.86% combined bounce rate (33.8% lower than industry average)

The Challenge:

CFCU aimed to boost member engagement through email marketing. They partnered with PLAY Creative to develop a strategy that would not just meet, but exceed industry standards.

The Strategy:

PLAY Creative implemented a comprehensive approach:

– Consistent monthly emails – Diverse, engaging content

– Mobile-friendly design

– Continuous performance analysis

The Results:

Over 14 months, CFCU saw remarkable improvements:

Open Rates Soared:

CFCU’s average open rate of 39.08% dwarfed the industry average of 21.6%. Their peak performance hit an astounding 51.5% in June 2023.

Click-Through Rates Excelled:

With an average CTR of 2.97%, CFCU outperformed the industry standard of 2.3%. Their best campaign achieved a phenomenal 13.39% CTR.

Healthy Subscriber List:

Low unsubscribe (0.21%) and bounce rates (0.86% combined) indicated a highly engaged audience.

Room for Improvement:

While most metrics exceeded benchmarks, the average click-to-open rate (CTOR) of 6.09% fell below the industry average of 10.6%, presenting an opportunity for future optimization.

Key Insights:

– Seasonal trends showed higher engagement during summer and January.

– Webmail dominated, but mobile readership grew steadily.

– Exceptionally high-performing campaigns in June 2023 and January 2024 provided valuable lessons for future strategies.

Conclusion:

By focusing on consistent communication, engaging content, and data-driven optimization, CFCU significantly outperformed industry benchmarks. This case study demonstrates the power of a well-executed email marketing strategy in the financial services sector. Want to learn how your credit union can achieve similar results? Contact PLAY Creative today for a personalized email marketing consultation.