Facebook Strategy Grows Current Member Loans

Facebook Strategy Overview:

Credit Union of American wanted to create an online marketing campaign in order to promote their auto loans and grow the value of current member accounts.

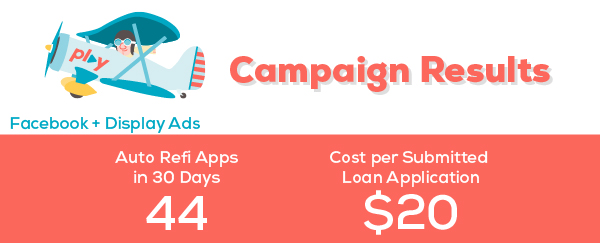

We created ads that stressed how easy it is for members and non-members to refinance with CUA and included benefits such as “90 days no repayment.” We then used Facebook to show these ads to the credit union members and led them to the online application, and the submissions started coming in. In just 30 days, Credit Union of America gained 44 new auto refinance applications and achieved the client’s goal of $20 per submitted loan application.

We helped CUA strengthen and retain current memberships, while also helping grow the value of each membership. The cost of growing a current member account is significantly lower than the cost of trying to gain a new member. This makes it a no-brainer to build a marketing strategy that is focused on cross-selling and up-selling to existing members. The barrier to entry on a campaign like this is significantly less expensive and has a much higher ROI than spending your marketing dollars on trying to gain new memberships. If you are just getting started with online marketing this is the most logical starting point, and PLAY Creative has the perfect Credit Union Starter Pack to launch such a campaign. Contact us today, for plans and pricing.

Online Marketing Executive Summary:

Here at PLAY, we created a plan that used advanced online marketing tactics, and custom-designed ads strategically shown to the right audiences, in order to encourage them to apply for auto refinancing and auto loans. We decided to create ads that spoke to pre-existing credit union members looking to avoid a costly payment upfront, while still gaining a high-quality loan.

Identifying the Problem:

The main problem was trying to cross-sell to current CUA members without an auto loan. PLAY needed to come up with a way to sell to this audience, while still highlighting the main benefits of the refinancing plan put in place by CUA.

Outlining the Marketing Approach:

We achieved the client’s goal by creating a custom Facebook audience and serving them with a variety of ads that touched upon the main selling points. The main selling points included 90 days no repayments, and the easy, online application process. Our audience consisted of members that already trusted CUA with other banking needs. PLAY needed to convince the audience that an auto refinance loan would be the next, natural step in their financial relationship with Credit Union of America.

Finding a Solution:

Our strategy to find a solution to Credit Union of America’s problem began by brainstorming the kind of language that pre-existing members would want to hear when shopping for auto loans and then simplifying that language in order to get at the heart of the matter. By keeping language concise and just focusing on a few key features, we were able to target members who wanted an easy, online loan experience.

Our imagery played into that same idea, thus leading to straightforward images or cars, showcasing what the member would get out of a simple, feast auto loan approvals. With a targeted Facebook member list, our ads had a wide reach and helped to convince those thinking of applying for an auto loan to make the final decision and apply.

Continuing the Marketing Strategy:

With a targeted Facebook member list and 44 applications in just 30 days, the campaign has been a huge success for Credit Union of America. The cost per application achieved one of the main goals set by the client. We continue to work with CUA today, creating campaigns with high conversion rates and a large reach.